You pull your credit report to see what’s holding you back—and it looks like the same debt is hitting you twice.

One line shows an old credit card that’s “charged off.” Another line shows a collection agency for what seems like the exact same amount. It’s hard not to think: Is this double reporting? Am I being punished twice? And if I pay one, does the other go away?

This is one of the most common “credit report panic” moments for people rebuilding credit. And the right next step isn’t to pay out of frustration or dispute everything in sight. It’s to slow down, understand what you’re looking at, and choose a strategy that matches your timeline and your goal.

This guide explains the difference between charge-offs vs collections in plain English, why the same debt can appear twice, and how to prioritize what to tackle first—without making risky assumptions or chasing quick fixes.

If the same debt shows twice, you’re not crazy—here’s why it happens

When you see one debt listed two ways, it usually looks like this:

- An original creditor tradeline (the bank or lender you originally borrowed from) showing “charged off” or “bad debt.”

- A collection tradeline from a collection agency referencing the same account or a very similar amount.

That can happen for a few reasons:

- The original lender charged off the account and then placed or sold it for collection.

In many cases, the original account doesn’t vanish just because a collector is now involved. The original tradeline can remain as part of your credit history, and a collection account may also be reported. - The account was transferred, and reporting details didn’t line up cleanly.

Sometimes the balance, dates, or account status don’t match between the two listings. That’s where confusion—and potential inaccuracies—show up. - There may be a reporting error or duplication issue.

It’s possible for reporting to be incomplete, inconsistent, or duplicated in ways that don’t make sense. The point is: you can’t know which category you’re in until you look closely at the details.

The important takeaway: seeing two entries doesn’t automatically mean “two separate debts.” But it also doesn’t automatically mean “credit report mistake.” Your next step is diagnosis.

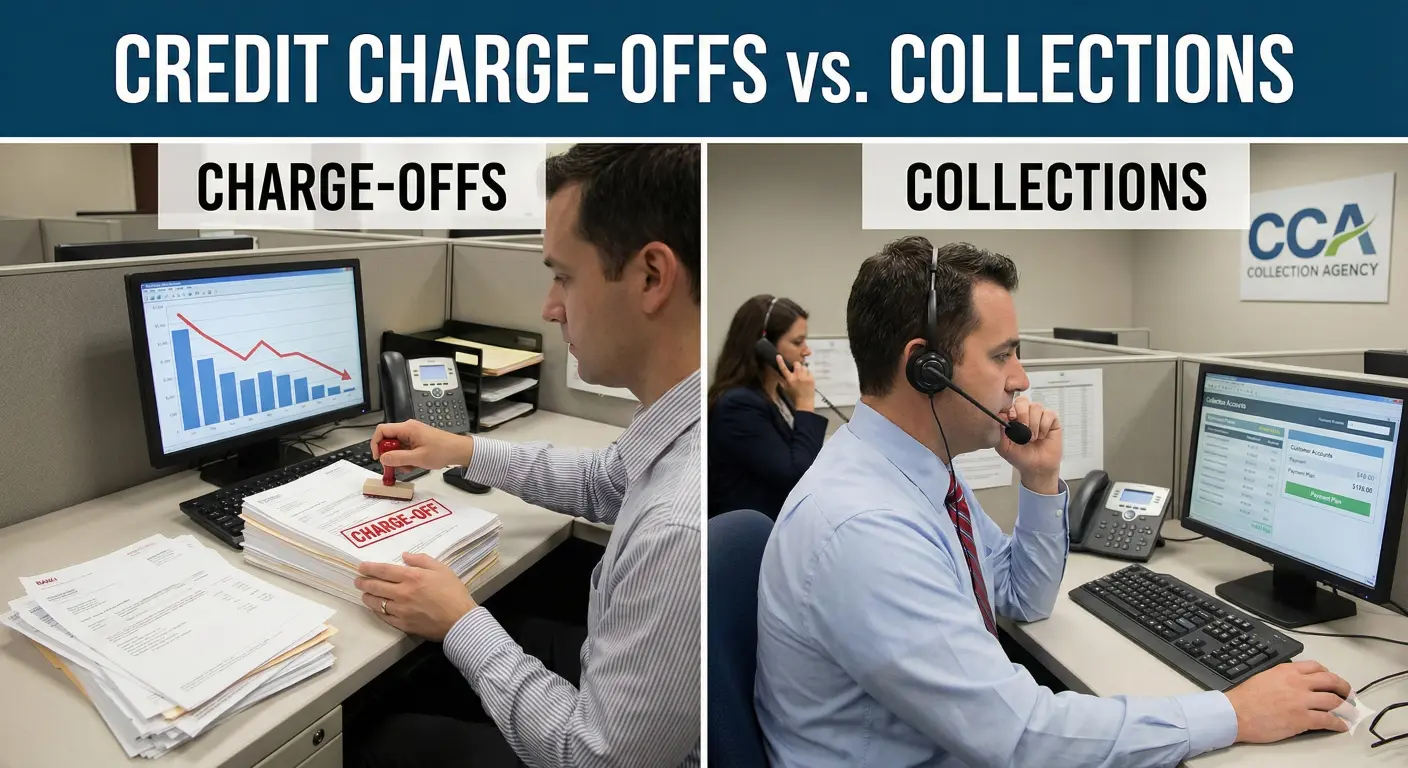

Definitions in plain English: charge-off vs collection

Let’s define the terms clearly, because most bad decisions start with misunderstanding what these labels mean.

A quick note: credit reporting rules and outcomes can vary depending on the lender, the collector, and your specific history. This is general information, not personal financial or legal advice.

What a charge-off means from the original lender’s perspective

A charge-off typically means the original creditor has decided the debt is unlikely to be collected and has moved it into a “loss” category for accounting purposes. It does not necessarily mean:

- The debt is forgiven

- You no longer owe it

- The creditor can’t pursue it (processes vary, and legal questions should be discussed with qualified counsel)

From a credit report perspective, a charge-off is a serious negative item. It’s the lender saying: “This account went bad.”

What a collection means and who owns the debt now

A collection usually means the debt is being pursued for payment by a third party (a collection agency) or sometimes by a different entity that purchased the debt.

A collector may be:

- Working on behalf of the original creditor, or

- Collecting on behalf of a company that now owns the debt

Your report may show the collector’s name and their version of the balance and status.

Why they can exist at the same time

Because they represent two different things:

- The original account history (what happened with the original lender)

- The collection activity (who is currently pursuing payment)

That’s why “charge off vs collection” isn’t just semantics. Each entry can affect your credit profile differently, and the right move depends on accuracy, timing, and your goals.

The diagnosis step: identify what you actually have in front of you

If you want to make smart decisions, you need to get specific about what’s on your report—not just the labels.

The simplest way to do this is to compare the charge-off tradeline and the collection tradeline side-by-side.

Start a quick notes page like this:

- Original creditor name:

- Account type (credit card, auto loan, etc.):

- Charge-off balance shown:

- Status wording:

- Dates shown (opened, last payment, last updated):

- Collection agency name:

- Collection balance shown:

- Status wording:

- Dates shown (opened, last updated):

- Any account numbers partially shown (last 4 digits) to match them:

Then use the checks below.

Are the amounts the same or different?

If the balances match exactly, it may indicate the collection is tied directly to the charged-off account.

If the balances differ, that doesn’t automatically mean it’s wrong. Differences can happen for several reasons (fees, interest, reporting timing—details vary and should be verified). But big inconsistencies are a signal to slow down and confirm what’s going on before paying or disputing.

Also watch for this pattern: one tradeline shows a balance, while another shows “$0” with a charged-off status. That might indicate the debt was transferred or sold, but you’ll still want to confirm the story is consistent.

Dates that matter: first delinquency vs last updated vs opened

Credit reports can show several dates, and they don’t all mean the same thing. Without getting overly technical, here’s a safe way to think about it:

- When the trouble began: the account first went delinquent and never recovered (often referenced as “first delinquency” in credit education contexts).

- When a company started reporting: a collector’s “opened” date may reflect when they began collection activity, not when the debt originally occurred.

- When a line item changed recently: “last updated” can simply mean the furnisher sent a routine update, not that something new happened financially.

Because date meanings vary by report format and furnisher, treat dates as clues, not verdicts. If you’re making a high-stakes decision (like preparing for a mortgage), it can be worth having a professional walk through how your specific report is being read by lenders.

Who is reporting: original creditor, collector, or both?

This is the core of the “same debt shows twice” confusion.

Ask:

- Is the original creditor still showing a balance?

- Does the collection show the same debt and balance?

- Are both marked active in a way that feels like double-counting?

Sometimes the reporting can be consistent and legitimate: one line shows a charged-off account history; the other shows collection activity.

Other times, the reporting looks messy: balances don’t align, statuses conflict, or the debt appears to be counted twice in a way that doesn’t make sense.

Either way, don’t decide what to do until you can clearly explain what each tradeline represents.

The misconception that hurts people: “If I pay it, it disappears”

This is the moment where people waste money—or make moves that don’t accomplish what they hoped.

Many people assume:

- “If I pay the collection, it will come off my report.”

- “If I pay the charge-off, it will be deleted.”

- “If I settle, everything will look clean.”

In reality, payment can change how an account is reported, but it doesn’t automatically erase history. The exact reporting outcome depends on the furnisher and how they update the account (TBD specifics for your situation).

That doesn’t mean paying is pointless. It means you should pay with a plan, not with a wish.

What “paid” can mean on a report (and what it doesn’t guarantee)

A paid or settled debt may be reported differently afterward—often as paid, settled, or closed with a balance of zero. But the tradeline itself may still remain as a record of what happened.

This is why the question “does paying a charge off remove it” has a frustrating answer: often, not in the way people mean “remove.” If your goal is to delete accurate history, that’s not typically something you can assume will happen. You should verify what outcomes are realistic before deciding.

When paying may still be strategically useful

Even if payment doesn’t delete the history, paying can still matter depending on your goal and timeline. For example:

- You want to show resolution of outstanding debts for future applications

- You’re trying to stop ongoing collection activity

- You’re working toward a larger financing goal where unresolved debts can create complications (details vary widely by lender and loan type)

If your next move has serious consequences—like buying a home—talk to a qualified lender or credit professional about how they view paid vs unpaid items in your specific context.

When paying without a plan creates regret

Paying “the loudest” collector on the phone, paying without understanding whether the debt is accurate, or paying without tracking documentation can lead to outcomes like:

- The wrong account gets resolved while the reporting doesn’t clean up

- You can’t prove what was agreed to later

- You still don’t know why the debt was listed twice

A good rule: if you can’t explain what you’re paying, why you’re paying it, and what you expect to change on the report afterward, pause and get clarity first.

Priority order: what to tackle first based on your situation

Now for the part you actually came for: what to tackle first.

There isn’t one universal order that fits everyone. But there is a reliable way to prioritize based on your scenario—especially if the same debt is showing twice.

Think of this as a decision tree.

If you believe the item is inaccurate or duplicated

Start here if:

- The balances don’t make sense

- The collector is reporting a debt you don’t recognize

- The same debt appears twice with conflicting status or amounts

- Key details are wrong (account numbers, dates, ownership)

First steps:

- Gather documentation that supports your understanding (see the documentation section below).

- Identify exactly what you’re disputing. Not “this whole thing,” but “this balance is incorrect” or “this account is not mine” or “this is duplicated reporting with conflicting details.”

- Dispute in a trackable way and keep copies of what you sent and what you received back.

Because dispute processes and best practices have nuance, you’ll want to follow reputable guidance (TBD sources) or get help if you’re unsure. The biggest mistake is firing off multiple disputes without a paper trail.

If the debt is accurate but you’re on a loan timeline

Start here if:

- You’re trying to qualify for a loan in the near term

- You need a plan that prioritizes what a lender is likely to care about most

- You can’t wait for a long cleanup process

First steps:

- Confirm what the loan decision will actually be based on. Different lenders and loan types may weigh items differently (TBD for your scenario).

- Focus on the denial reasons that are most likely to block approval—for many people that’s unresolved derogatories and high utilization, but don’t assume.

- Choose one path and document it: pay, settle, or dispute inaccuracies.

If your goal is mortgage readiness, coordinate your plan with a qualified lender. Some actions that seem helpful can create extra questions during underwriting, and you don’t want surprises.

If you’re rebuilding slowly and want the cleanest long-term path

Start here if:

- You’re not applying for major credit immediately

- You want to improve your overall creditworthiness over time

- You want a sustainable plan, not a sprint

First steps:

- Get clarity first: make sure the reporting story is consistent.

- Resolve what you can resolve intentionally and build positive history at the same time.

- Avoid random moves like opening accounts too quickly or disputing everything at once.

Long-term rebuilding is often about consistency: clean documentation, fewer reactive decisions, and a plan that you can actually follow for months.

Decision points: pay, settle, dispute, or focus on rebuilding history

Here’s how to decide without overpromising outcomes:

- Dispute when you have a clear reason and evidence the reporting is wrong or incomplete.

- Pay or settle when the debt is accurate and resolution supports your bigger goal (even if the history may remain).

- Focus on rebuilding history when you can’t change the past but you can improve what lenders see going forward.

Most people are not choosing just one. They’re choosing the right sequence.

Common failure modes (and how to avoid them)

When people get stuck with charge-offs and collections, it’s rarely because they didn’t try. It’s because they tried the wrong thing first.

Disputing everything at once with no evidence

This can lead to:

- Confusing results

- Verified responses that don’t move anything

- A feeling of “nothing works”

Instead:

- Dispute one issue at a time that you can document

- Track dates, responses, and what you sent

Paying a collector without getting clear documentation (TBD specifics)

People often pay under pressure—then later struggle to prove:

- What amount was agreed to

- Whether it was a settlement

- What would happen next in reporting

Instead:

- Keep your communications organized

- Get confirmation of what you’re paying and why (the exact form of documentation can vary and should be verified for your situation)

Ignoring the original creditor tradeline entirely

Sometimes people focus only on the collection and forget the charged-off account is still on the report.

Instead:

- Review both tradelines

- Make sure the balances and statuses are consistent

- Track whether resolving one changes the other (it may, but don’t assume)

Letting “updated monthly” reporting confuse your next move

Many people see “updated monthly” and assume:

- The debt is growing

- Something new is happening

- They’re being re-punished each month

In some cases, it may simply reflect routine reporting updates. In other cases, it may signal a change worth investigating. The key is not to interpret it emotionally—verify what exactly is updating and whether the balance or status is changing.

If you’re unsure, that’s a good reason to get a structured credit report review.

What to document before you act (so you stay in control)

If you take one idea from this article, make it this:

You’ll make better decisions when you have your own “one-page debt file.”

Here’s what to gather and track before you dispute, pay, or negotiate.

Your one-page debt file checklist

For each debt that appears as a charge-off and/or a collection, collect:

- Screenshots or PDFs of the tradeline details from each bureau report (if available)

- Original creditor name and account identifiers (partial account number if shown)

- Collector name and account identifiers

- Balances shown for each tradeline

- Dates shown (opened, last updated, and any delinquency indicators)

- Notes of any calls: date, who you spoke with, what was said

- Any letters or emails you’ve received

- Proof of payments made (if any): confirmations, receipts, bank record references

What to record from calls and letters

If you talk to anyone—creditor or collector—record:

- Date and time

- Representative name or ID (if offered)

- A short summary of what you asked and what they said

- Any next steps they told you to take

This protects you from “he said, she said” situations later.

How to track outcomes and next steps

A simple tracking table in a note or spreadsheet is enough:

- Account

- Action taken (dispute sent, payment made, etc.)

- Date taken

- Expected follow-up date

- Result received

- Next step

It doesn’t have to be fancy. It just has to exist.

How to verify progress without guessing

After you take action—whether you dispute, pay, or settle—you want to verify progress in a grounded way.

What changes you might see on reports after actions (wording varies)

Depending on what you did and how the furnisher reports, you might see changes like:

- Balance updates

- Status changes (paid, settled, closed, etc.)

- Notes that an account was transferred or sold

- Removal of a duplicate or correction of inaccurate fields

Because report wording varies and outcomes depend on the details, avoid assuming one specific “perfect” result. Focus on accuracy and consistency.

What “good” looks like: accurate status, consistent amounts, no obvious duplicates

You’re aiming for:

- The story makes sense across tradelines

- Amounts and ownership are consistent

- You can explain what happened and what changed

Even if a negative item remains as history, accuracy and consistency matter—especially when you’re rebuilding and planning future applications.

When to consider getting help for a structured review

If any of these are true, a structured review can save you time:

- You can’t tell whether the two listings are legitimate or erroneous

- The debt appears to be reported inconsistently across bureaus

- You’re on a timeline for financing and don’t want missteps

- You’ve disputed before and keep getting “verified” without clarity

A good review should help you prioritize, document, and choose a sequence—not promise a specific outcome.

Next step: get a clear plan for charge-offs, collections, and reporting issues

If the same debt shows up twice, you shouldn’t have to guess what to do first. The right move depends on what’s accurate, what’s inconsistent, and what your timeline looks like.

If you want a clear, step-by-step plan, it can help to have a professional read your report with you, identify what’s actually happening, and map your options.

FAQ

Should I pay a charge-off?

It depends on your goals, timeline, and whether the reporting is accurate. Paying may help resolve an outstanding debt and can change how it’s reported, but it doesn’t automatically remove the history. If you’re making a high-stakes application soon, consider consulting a qualified lender or credit professional before deciding.

Charge-off and collection both on my report—what should I do?

Start by comparing the two tradelines side-by-side. Confirm whether they refer to the same debt, whether balances and dates are consistent, and whether anything looks inaccurate or duplicated. From there, choose a strategy: dispute inaccuracies with documentation, or resolve accurate debts intentionally based on your timeline.

How do I dispute a charge-off the right way?

In general, it’s safest to dispute specific inaccuracies you can document—such as incorrect balances, dates, ownership, or accounts that aren’t yours—rather than disputing everything broadly. Keep copies of what you send, track responses, and follow reputable guidance (TBD source) or get help if you’re unsure.

Does paying a charge-off remove it from my credit report?

Often, paying a charge-off does not automatically delete the account from your report. It may update the status or balance to reflect that it’s paid or settled, but the history may remain. The exact result can vary, so it’s best to verify what changes actually occur on your reports.

Why does my charge-off show “updated monthly,” and does it matter?

“Updated monthly” can sometimes reflect routine reporting updates rather than a new negative event. However, it’s worth checking whether the balance, status, or comments are changing. If you’re unsure what’s being updated or why, a structured review can help clarify what it means for your situation.

Is it normal for the same debt to appear twice on a credit report?

It can happen, especially when an original creditor charges off an account and a collection agency reports collection activity. Sometimes it’s legitimate and consistent; sometimes it’s inaccurate or confusing. The key is to verify details—amounts, dates, and reporting parties—before taking action.

Request a Credit Report Review for Charge-Offs and Collections

If the same debt shows up twice, you shouldn’t have to guess what to do first. We can review your report, identify whether the reporting looks accurate, and map a step-by-step plan based on your timeline and goals. No hype—just clear priorities and what to document before you act. Request a charge-off and collections review to get your next steps.